Mobile Import in Pakistan – Custom on Mobile Phones

How to Import a Mobile Phone to Pakistan [Complete Guide]

Mobile Import in Pakistan is much easier but the procedure is a bit difficult for the peoples who are importing a phone first time from abroad. This process takes some time and some legal formalities. So, in this article, I’ll guide you step by step How to Import a Phone to Pakistan and how much Tax & Custom you have to pay. Here are the detailed steps that we need to follow to have a phone you love delivered to your home:

- Select the Desired Mobile Phone.

- Choose an Online Store / Website where you want to buy.

- Pay for your phone using your preferred method of payment.

- Get the detail of shipping, online tracking number, an invoice from the seller.

- Wait for the Mail or Call from International Mail Office (IMO).

- Check the Requirements of the International Mail Office (IMO)

- Get Personal COC from PTA.

- Visit International Mail Office (IMO) to release your Phone from Customs.

- Pay customs duties and other charges to the Post Office (Located inside the International Mail Office).

- Take and Check your Mobile Phone and Enjoy it.

Also Read: How to Use Function Keys on Laptop – F1 to F12

Detailed Procedure of Mobile Import in Pakistan

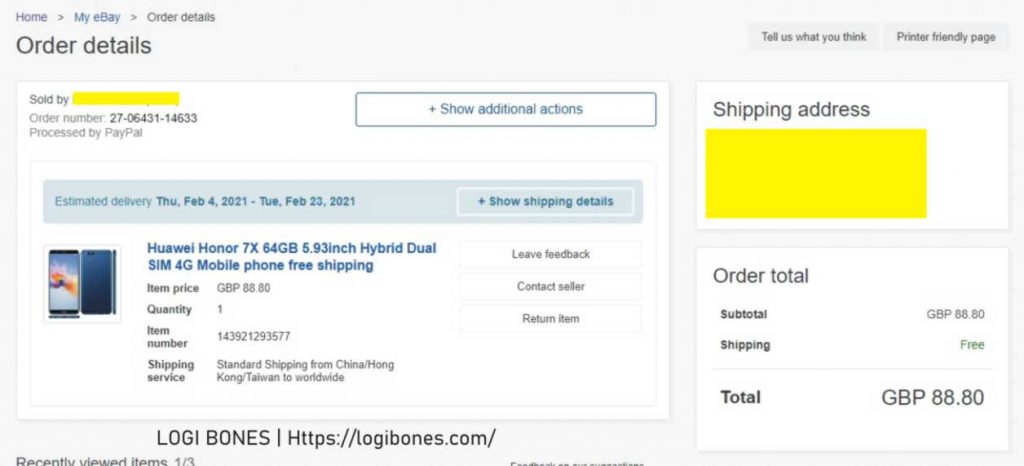

Below, I will detail how I recently imported a Huawei Honor X7 to Pakistan and all the steps I had to go through to get it.

I was curious how to import a mobile phone from some other country. That’s why I decided to buy one from EBAY. It is not a very expensive or a new model phone but I just want to check the procedure. So, I ordered a Phone from ebay.

It was priced $121 (88.80GBP) when I bought it.

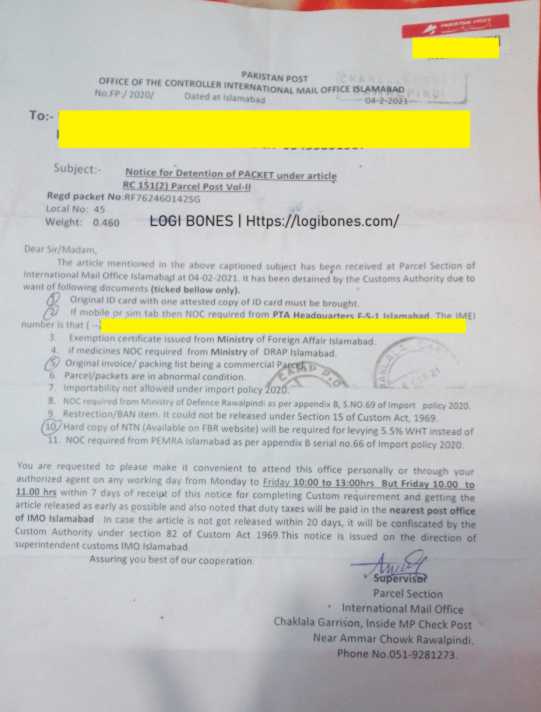

I ordered it on the 19th of January, they shipped it on 23rd January, it reached in Pakistan on 2nd of February at Karachi airport; then reached International Mail Office (IMO). I received a Notice for Detention of Packet from IMO on the 7th of February. As you can see in the pic below the tick some required documents to release the Parcel.

- CNIC and an Attested Copy of CNIC

- COC from PTA

- Original Invoice of Parcel

- NTN number for Filers (Tax Payers)

How can You Get COC from PTA?

Getting COC is a very Simple but a little complicated process. You can get it through some agent outside the GPO who will ask you to fill an application form for COC. You can do that too. But I strongly recommend you to go to Pakistan Telecommunication Authority (PTA) website, create your own account and apply for Personal COC yourself.

PTA required these documents if you are applying for COC online:

- Your Scanned Copy of CNIC (Both Sides)

- Scanned Copy of Invoice of Parcel (mobile phone)

- Custom Detention Letter (Scanned Copy)

- IMEI Number of Mobile Phone, Tracking Number, Invoice Number, and Some Other Detail to Proof Your Identity.

Also Read: Richest Actors of The World: Top 10 Ranking

PTA Application Tracking

After applying for COC with PTA, you will get an application online tracking number. Keep it with you, it will help you track your application.

PTA usually processes personal COC applications within the same working day (mostly within 3-4 hours). It is necessary to provide correct detail to PTA, otherwise, they can reject your application if some documents are missing but they will let you know what’s missing. You can re-apply by attaching the missing documents with your new application but it can take more time to approve.

You should submit all documents in a single PDF file.

The arrival of COC (PTA) — Mobile Import in Pakistan

Then came the patience period as it took four days for the NOC to reach me via Leopard Courier Service. Unfortunately, you can’t rush for this.

When I got the COC, I took it to the IMO along with the Customs Detention Letter and went to the Customs Department in International Mail Office (IMO) Rawalpindi.

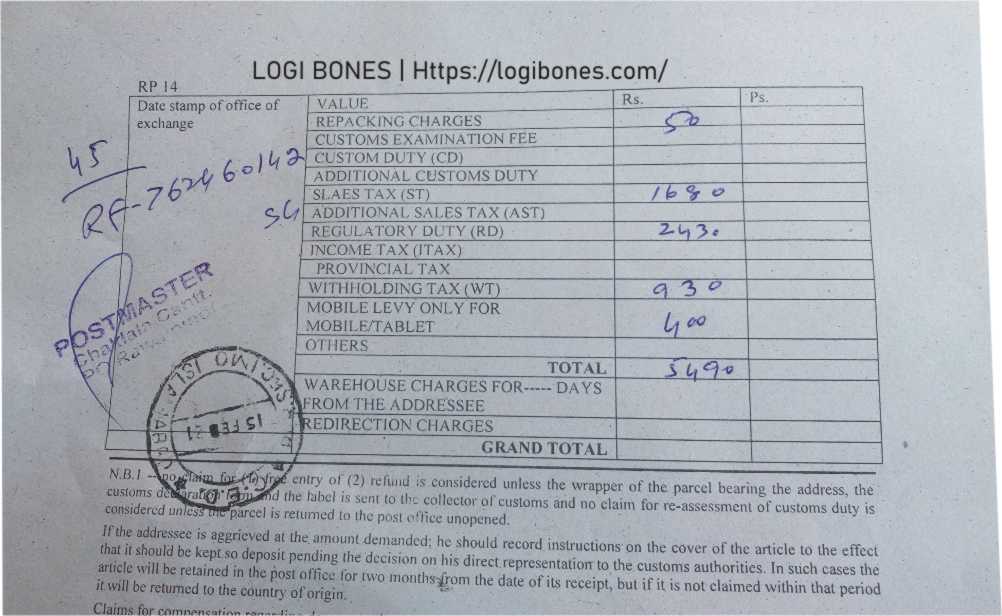

The guy there took a look at the documents, asked me for the COC, and then asked me to wait. He found the parcel, calculate the Custom and other taxes and give the slip to pay that tax in Post Office. Post Office is also located in the same building, I went and pay TAX. When I went back that guy gives me the Parcel.

Tax Rates for Commercial / Courier Import

| S No. | Mobile Phone Price in USD | Regulatory Duty | Sales Tax | With Holding Tax | Mobile Levy | Total Tax |

|---|---|---|---|---|---|---|

| 1 | Up to 30$ | 165 | 135 | 70 | 0 | 370 |

| 2 | Above 30$ and Up to 100$ | 1620 | 1320 | 730 | 0 | 3670 |

| 3 | Above 100$ and Up to 200$ | 2430 | 1680 | 930 | 400 | 5440 |

| 4 | Above 200$ and Up to 350$ | 3240 | 1740 | 970 | 1200 | 7150 |

| 5 | Above 350$ and Up to 500$ | 9450 | 5400 | 3000 | 2800 | 20650 |

| 6 | Above 500$ | 16650 | 9270 | 5200 | 5600 | 36720 |

Tax Rates for Baggage Import

| S No. | Mobile Phone Price in USD | Regulatory Duty | Sales Tax | With Holding Tax | Mobile Levy | Total Tax |

|---|---|---|---|---|---|---|

| 1 | Up to 30$ | 165 | 135 | 0 | 0 | 300 |

| 2 | Above 30$ and Up to 100$ | 1620 | 1320 | 0 | 0 | 2940 |

| 3 | Above 100$ and Up to 200$ | 2430 | 1680 | 0 | 400 | 4510 |

| 4 | Above 200$ and Up to 350$ | 3240 | 1740 | 0 | 1200 | 6180 |

| 5 | Above 350$ and Up to 500$ | 9450 | 5400 | 0 | 2800 | 17650 |

| 6 | Above 500$ | 16650 | 9270 | 0 | 5600 | 31520 |

I hope this guide will help others to buy mobile phones online from other countries. Thanks to reading.